Market outlook 27 04-10

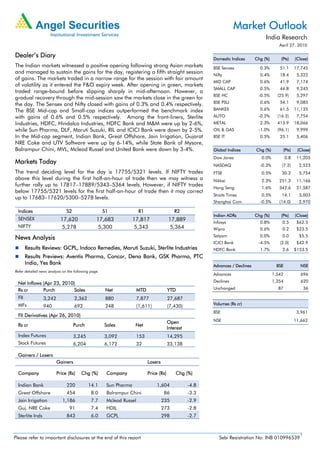

- 1. Market Outlook India Research April 27, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The Indian markets witnessed a positive opening following strong Asian markets BSE Sensex 0.3% 51.1 17,745 and managed to sustain the gains for the day, registering a fifth straight session Nifty 0.4% 18.4 5,322 of gains. The markets traded in a narrow range for the session with fair amount MID CAP 0.6% 41.9 7,174 of volatility as it entered the F&O expiry week. After opening in green, markets SMALL CAP 0.5% 44.8 9,245 traded range-bound before slipping sharply in mid-afternoon. However, a BSE HC -0.5% (25.9) 5,297 gradual recovery through the mid-session saw the markets close in the green for BSE PSU 0.6% 54.1 9,085 the day. The Sensex and Nifty closed with gains of 0.3% and 0.4% respectively. The BSE Mid-cap and Small-cap indices outperformed the benchmark index BANKEX 0.6% 61.5 11,135 with gains of 0.6% and 0.5% respectively. Among the front-liners, Sterlite AUTO -0.2% (16.2) 7,754 Industries, HDFC, Hindalco Industries, HDFC Bank and M&M were up by 2-6%, METAL 2.3% 413.9 18,066 while Sun Pharma, DLF, Maruti Suzuki, RIL and ICICI Bank were down by 2-5%. OIL & GAS -1.0% (96.1) 9,999 In the Mid-cap segment, Indian Bank, Great Offshore, Jain Irrigation, Gujarat BSE IT 0.5% 25.1 5,406 NRE Coke and UTV Software were up by 6-14%, while State Bank of Mysore, Balrampur Chini, MVL, Mcleod Russel and United Bank were down by 3-4%. Global Indices Chg (%) (Pts) (Close) Dow Jones 0.0% 0.8 11,205 Markets Today NASDAQ -0.3% (7.2) 2,523 The trend deciding level for the day is 17755/5321 levels. If NIFTY trades FTSE 0.5% 30.2 5,754 above this level during the first half-an-hour of trade then we may witness a Nikkei 2.3% 251.3 11,166 further rally up to 17817–17889/5343–5364 levels. However, if NIFTY trades Hang Seng 1.6% 342.6 21,587 below 17755/5321 levels for the first half-an-hour of trade then it may correct Straits Times 0.5% 14.1 3,003 up to 17683–17620/5300–5278 levels. Shanghai Com -0.5% (14.0) 2,970 Indices S2 S1 R1 R2 Indian ADRs Chg (%) (Pts) (Close) SENSEX 17,620 17,683 17,817 17,889 Infosys 0.8% 0.5 $62.5 NIFTY 5,278 5,300 5,343 5,364 Wipro 0.6% 0.2 $23.5 Satyam 0.0% 0.0 $5.5 News Analysis ICICI Bank -4.5% (2.0) $42.9 Results Reviews: GCPL, Indoco Remedies, Maruti Suzuki, Sterlite Industries HDFC Bank 1.7% 2.6 $153.5 Results Previews: Aventis Pharma, Concor, Dena Bank, GSK Pharma, PTC India, Yes Bank Advances / Declines BSE NSE Refer detailed news analysis on the following page. Advances 1,542 696 Net Inflows (Apr 23, 2010) Declines 1,354 620 Rs cr Purch Sales Net MTD YTD Unchanged 87 36 FII 3,242 2,362 880 7,877 27,687 MFs Volumes (Rs cr) 940 692 248 (1,611) (7,430) BSE 3,961 FII Derivatives (Apr 26, 2010) Open NSE 11,662 Rs cr Purch Sales Net Interest Index Futures 3,245 3,092 153 14,295 Stock Futures 6,204 6,172 32 33,138 Gainers / Losers Gainers Losers Company Price (Rs) Chg (%) Company Price (Rs) Chg (%) Indian Bank 220 14.1 Sun Pharma 1,604 -4.8 Great Offshore 454 8.0 Balrampur Chini 86 -3.3 Jain Irrigation 1,186 7.7 Mcleod Russel 235 -2.9 Guj. NRE Coke 91 7.4 HDIL 273 -2.8 Sterlite Inds 843 6.0 GCPL 298 -2.7 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Result Reviews Godrej Consumer Godrej Consumer (GCPL) reported its 4QFY2010 results. GCPL reported strong Top-line growth at 48% yoy to Rs509cr (Rs344cr), in-line with our expectations of a 51% yoy growth to Rs519cr. Godrej-Sara Lee (GSL) contributed Rs147cr to the Top-line for the quarter. However, adjusted for GSL’s revenue, GCPL posted a growth of 5.3% yoy to Rs362cr which was below our expectation. Moreover, international operations (particularly Africa) registered strong growth during the quarter (we estimate it at ~19% yoy) which indicates that domestic operations (without GSL) grew just 1.9% yoy. While our talks with the management indicate no evident pressures on volume in Soaps or Hair Colour, the muted growth in domestic business has come as a negative surprise to us. GCPL’s consolidated Earnings for the quarter registered a growth of 55% yoy to Rs92cr (Rs59cr) ahead of our estimates of a 37% yoy growth to Rs81cr. In terms of Earnings, GSL’s consolidation contributed Rs23cr during the quarter, adjusted for which the growth in Bottom-line stood at 16% yoy to Rs69cr. Robust growth in Top-line and Margin expansion boosted Earnings. At the operating front, GCPL delivered a Margin expansion of 154bp yoy to 21.1% (19.6%) driving a 60% yoy growth in EBITDA to Rs101cr (Rs44cr) partially aided by a low base and GSL’s consolidation. A 614bp yoy jump in Gross Margins (owing to low base effect) and decrease of 62bp yoy in Staff costs were the key drivers behind the Margin expansion. We maintain an Accumulate on the stock with a Target Price of Rs329. Indoco Remedies Indoco Remedies announced its 4QFY2010 results which were ahead of our expectation. Net Sales came in at solid Rs108.9cr (Rs85.0cr) up 28.1% driven by both Domestic and Export market. Domestic Formulation sales came in at strong Rs71.8cr (Rs57.7cr) up 24.5% on back of traction in the Anti-infective, Dental and Respiratory segments while Export Formulation clocked in Revenue of Rs31.2cr (Rs23.3cr) up 34.2% yoy driven by Regulated markets. However OPM expanded by only 228 bp to 10.1% (7.9%) which was below our expectation on account of higher Raw material expenses which increased by 64.5% yoy. The company reported Net Profit of Rs8.23cr (Rs3.9cr) up 111% on back of solid Top-line growth and lower interest expenses. For FY2010, the Net Sales clocked in at Rs398.3cr (Rs350.6cr) up 13.6% while Net Profit came in at Rs42.1cr (Rs31.4cr) up 33.9% yoy. At Rs 412, the stock is currently trading at 10.4x FY2011E and 7.6x FY2012E earnings (Excluding any upsides from the Watson and Aspen deals). We maintain a Buy on the stock with a Target Price of Rs487. Maruti Suzuki For 4QFY2010, Maruti reported Turnover of Rs8,425cr (Rs6,433cr), up 31% yoy, which came primarily on the back of a robust 22.5% yoy increase in Volume and 7.6% yoy jump in Average Realisations. OPM stood at 13.2% (7%) owing to the 329bp contraction in Raw Material costs, which accounted for 73% (76.2%) of Net Sales, and overall achieving optimum operating leverage. Maruti recorded Net Profit of Rs657cr (Rs243cr), which also was below our expectation of Rs705cr. For FY2010-12E, we estimate the company’s Top-line to record CAGR of 16.1% to and Net Profit to clock a CAGR of 11% following dip in Operating Margins (due to higher input costs and higher advertising expenditure). We have marginally downgraded our EPS estimates for FY2011E to Rs93.3 (Rs96.6 earlier) and for FY2012E to Rs105.9 (Rs109.8). At the CMP, the stock is trading at 14.8x and 13.1x FY2011E and FY2012E Earnings. We maintain a Buy on Maruti with a revised Target Price of Rs1,694 at which the stock would trade at 16x FY2012E EPS. April 27, 2010 2

- 3. Market Outlook | India Research Sterlite Industries Sterlite’s net revenue grew by 64% to Rs7,111cr, in-line with our estimates of Rs7,180cr, aided by higher metal prices, strong performance by zinc and lead business and higher by-product prices (such as acid realisations and silver). The company sold 405mn units of merchant power (as compared to 47mn units in 2QFY2009), due to the closure of the BALCO 1 plant. EBITDA margins expanded 1,135bp to 29.1%, led by higher metal and by-product prices. Other income increased by 18.3% yoy to Rs549cr. The net profit increased by 130.8% yoy to Rs1,381cr, in-line with our estimates of Rs1,422cr. We maintain a Buy on the stock with a Target Price of Rs980. Result Previews Aventis Pharma (1QCY2010) Aventis Pharma (Aventis) is slated to announce its 1QCY2010 results today. Net Sales is expected to increase by 8% to Rs247.2cr (Rs228.9cr) with OPM estimated to remain flat at 16.0% (17.0%). As a result, Net Profit is expected to come down by 3.9% to Rs38.9cr (Rs40.5cr) on back of lower OPM and Other Income. We recommend a Reduce on the stock with a Target Price of Rs1,658. Container Corporation of India Container Corporation of India (Concor) is scheduled to announce its 4QFY2010 results today. The rail container operator is expected to grow by 13.6% yoy in its Top-line to Rs955cr, on account of low base and improvement in Exim volumes. We expect Concor’s OPM to improve by 193bp yoy to 28.7% on account of lower empties. Consequently, we expect the net profit to increase yoy to Rs 213.1cr. At the CMP, the stock is trading at 17.5x its FY2012E EPS of Rs 82. We maintain our Neutral rating on the stock. Dena Bank Dena Bank is scheduled to announce its 4QFY2010 results today. We expect the net profit of the bank to be flat on a yoy basis at Rs110cr. The bank is expected to post a strong Net Interest Income growth of 29% yoy to Rs310cr. The operating income growth is expected to be 15%. We will be closely watching slippages from the restructured loans of the bank which stand at Rs1,450cr, forming 4.7% of the advances. At the CMP, the stock is trading at attractive valuation of 3.8x FY2012E EPS of Rs22.3 and 0.7x FY2012E Adjusted Book Value of Rs119. We have a Buy rating on the stock with a Target Price of Rs95. GlaxoSmithKline Pharma GlaxoSmithKline Pharma (Glaxo) is scheduled to announce its 1QCY2010 results today. Net Sales is expected to increase by 12.5% to Rs514.3cr (Rs457.3cr) with OPM estimated to remain flat at 34.3% (34.2%). However, Net Profit is expected to come down by 7.3% to Rs132.8cr (Rs143.3cr) on back of lower other Income. We recommend a Reduce on the stock with a Target Price of Rs1,700. April 27, 2010 3

- 4. Market Outlook | India Research PTC India PTC India is expected to announce its 4QFY2010 results today. We expect the company to record a 57.8% yoy growth in its standalone Top-line to Rs1,862cr. We expect the company to trade 4,900MU of power during the quarter, resulting in an increase of 124% yoy. We have assumed an average realisation of Rs3.8/unit. We expect the company to post a 6.6% growth in net profit to Rs16.5cr. We maintain a Buy on the stock with a Target Price of Rs136. Yes Bank Yes Bank is scheduled to announce its 4QFY2010 results today. The bank is expected to post a strong Net profit growth of 74% yoy to Rs139cr. The Net Interest Income is estimated to grow by 72% yoy to Rs267cr. The operating income growth is expected to be 67%. At the CMP, the stock is trading at 16.1x FY2012E EPS and 2.2x FY2012E Adjusted Book Value. We have a Neutral rating on the stock. Economic and Political News Govt. for discussion on FDI in multi-brand retail Inflation expectation may ease further: RBI FDI in Retail sector likely to be liberalised Corporate News Govt. plans to hike ONGC gas price to US $4/mmbtu Gujarat NRE places US $90mn order for longwall systems Rajesh Exports to roll out 300 retail stores Welspun completes Rs156cr QIP Source: Economic Times, Business Standard, Business Line, Financial Express, Mint April 27, 2010 4

- 5. Market Outlook | India Research Events for the day ARSS Infrastructure Projects Results Aventis Pharma Results Container Corporation of India Results Dena Bank Dividend, Results Gillette India Results GSK Pharma Results Goodyear India Results Greaves Cotton Dividend, Results IDFC Dividend, Results Ispat Industries Results JSW Energy Dividend, Results Motilal Oswal Dividend, Results Navneet Publications Results Petronet LNG Dividend, Results Piramal Life Results Power Finance Corporation Results PTC India Results Raymond Results Shree Renuka Sugars Results TajGVK Hotels Results Welspun Gujarat Dividend, Results Yes Bank Dividend, Results April 27, 2010 5

- 6. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 April 27, 2010 6